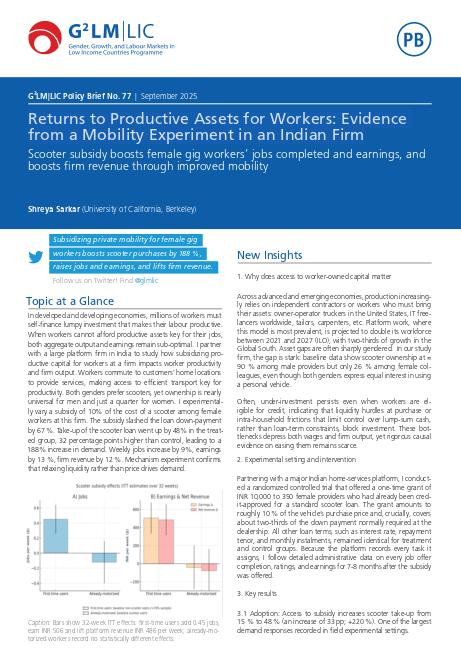

In developed and developing economies, millions of workers must self-finance lumpy investment that makes their labour productive. When workers cannot afford productive assets key for their jobs, both aggregate output and earnings remain sub-optimal. I partner with a large platform firm in India to study how subsidizing productive capital for workers at a firm impacts worker productivity and firm output. Workers commute to customers’ home locations to provide services, making access to efficient transport key for productivity. Both genders prefer scooters, yet ownership is nearly universal for men and just a quarter for women. I experimentally vary a subsidy of 10% of the cost of a scooter among female workers at this firm. The subsidy slashed the loan down-payment by 67 %. Take-up of the scooter loan went up by 48% in the treated group, 32 percentage points higher than control, leading to a 188% increase in demand. Weekly jobs increase by 9%, earnings by 13 %, firm revenue by 12 %. Mechanism experiment confirms that relaxing liquidity rather than price drives demand.